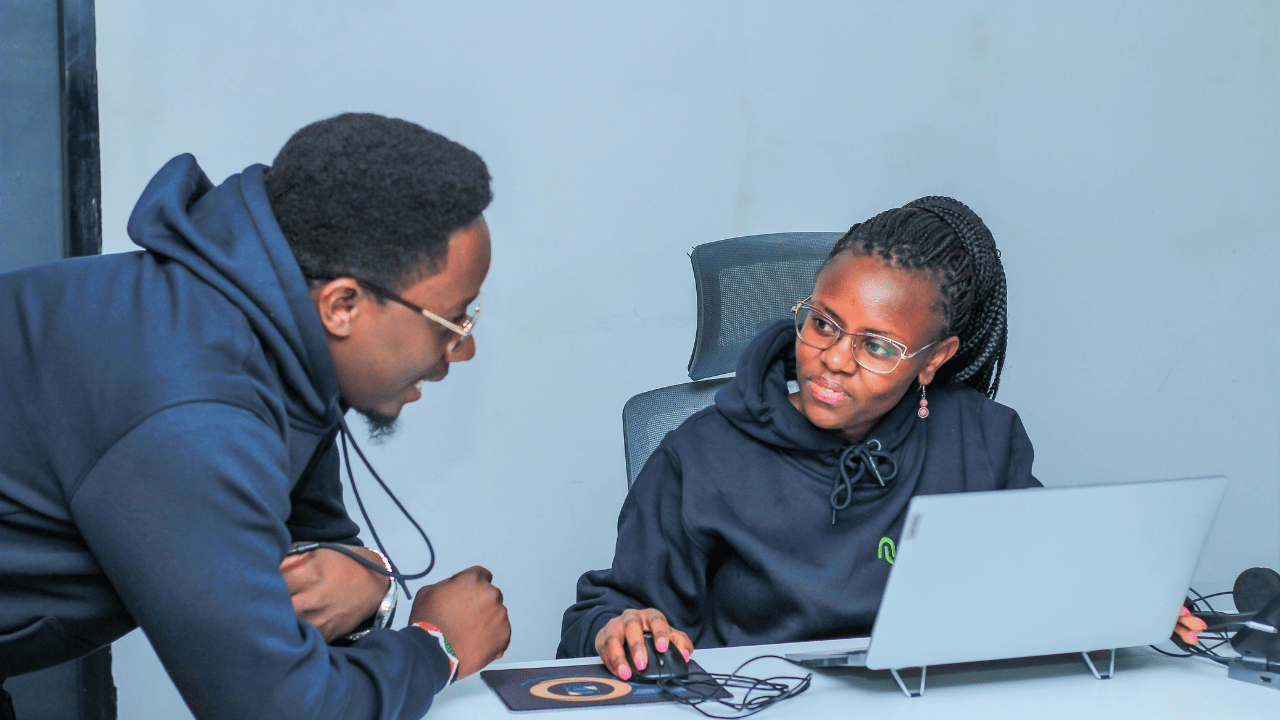

Africa’s start-up scene is alive with ambition. From Ghana to Nairobi to Cape Town, thousands of founders are solving problems at blistering speed, backed by record levels of investment. Yet when some of these firms expand beyond their borders, success at home can quickly turn into struggle abroad.

The paradox is familiar: how can a business that thrives locally falter globally?

The answer lies not in vision but in preparation. Global expansion is rarely just about crossing borders; it is about crossing thresholds of culture, legal, capital, and capability.

This article unpacks the reasons global expansion so often fails. Using evidence from African start-ups and distilling the lessons every founder should learn before taking their company across borders. It closes with a look at how firms such as Kharis Global Group, which specialises in international compliance and operational support, help organisations turn global ambition into durable growth.

What Is Global Expansion?

Global expansion sounds deceptively simple: open a branch abroad, hire people, deliver services or ship products, and profits come. In practice, it is a multistage transformation touching every layer of a company: structure, culture, finance, and legal identity.

According to the Organisation for Economic Co-operation and Development (OECD), successful internationalisation depends on an organisation’s ability to adapt its governance and operations to diverse regulatory and cultural contexts. Harvard Business Review defines global expansion as “expanding your business overseas, exploring foreign markets, and increasing your operations abroad.”

In plainer terms, expansion is not geography; it’s integration. It requires:

- Regulatory alignment: understanding tax, labour, and compliance frameworks in target countries.

- Cultural fluency: tailoring branding, pricing, and communication to local norms.

- Operational scalability: building systems capable of handling multi-currency payroll, cross-border logistics, and distributed teams.

- Financial readiness: securing capital buffers for delayed revenues and higher compliance costs.

Start-ups often skip this preparatory work. A McKinsey & Company analysis of emerging-market firms (2023) found that more than 70 per cent of expansion failures stemmed from inadequate operational readiness, not lack of demand. The insight is sobering: most founders fail globally because they never mastered the unglamorous machinery of scaling.

The Mirage of “Going Global”: What Expansion Really Entails

For many founders, “going global” has become a badge of honour. Investors celebrate it; headlines reward it. Yet beneath the glamour lies what could be called the mirage of global expansion, the belief that success in one market guarantees success everywhere.

Data from CB Insights (2024) highlights that roughly one in three start-ups that expand internationally fail within 24 months, with the most common reasons being “poor localisation” and “weak market insight.” The rush to announce international offices often outweighs the sober need to re-validate the product-market fit.

Take Jumia, once hailed as “the Amazon of Africa.” Its early leap into multiple markets strained logistics and profitability; within a few years, the company retracted operations to focus on stronger territories. Similarly, several fintechs that found product-market fit in Nigeria or Kenya have stumbled when exporting their models to regions with stricter compliance regimes.

The lesson is not to avoid ambition but to refine it.

True expansion means rebuilding the business around a new context, not merely exporting the old one. That involves:

- Market immersion: months of on-ground research and partnership building.

- Legal and financial foresight: understanding how exchange-control laws, import tariffs, or data-privacy acts can reshape unit economics.

- Human capital readiness: hiring local expertise rather than transplanting entire home-market teams.

Global expansion fails when firms mistake replication for adaptation.

Why African Start-ups Struggle Abroad

Africa’s start-ups operate in some of the world’s most complex markets. That same resilience, however, can become a liability abroad. When these firms enter new jurisdictions, four structural hurdles often emerge.

1. Regulatory mismatches

Fintechs such as Flutterwave, Paystack, and Chipper Cash have learned that payment licences that satisfy African regulators often fall short in North America or Europe. The World Bank Doing Business Index ranks many African economies lower on regulatory transparency, which means founders may underestimate the paperwork intensity of developed markets.

2. Cultural misalignment

Brand tone and user expectations differ dramatically. A Kenyan logistics start-up accustomed to informal negotiation might find European consumers rigid about terms of service. Misunderstanding local communication cues can derail partnerships before contracts are even drafted.

3. Funding and network gaps

Late-stage venture capital still clusters in the United States and parts of Asia. According to the Partech Africa 2024 Funding Report, only about 4 per cent of total global venture capital reached African start-ups in 2023. The result: many founders lack the mentoring and investor networks needed for sustained foreign expansion.

4. Operational foundations

Cross-border tax, payroll, and logistics systems remain fragile. Without unified back-office processes, expansion creates administrative chaos. As one IFC report bluntly put it, “African SMEs are often globally ambitious but domestically disorganised.”

These challenges don’t stem from incompetence. They stem from asymmetry between ambition and infrastructure.

The Core Mistakes: Lessons in What Not to Do

When analysts dissect why global expansion fails, a few recurring missteps appear.

Expanding too early

Founders sometimes conflate early traction with saturation. The desire to impress investors with international growth leads to premature scaling. CB Insights lists “expanding too fast” among the top five causes of start-up death.

Neglecting localisation

Copy-pasting a home-market strategy into a foreign one is tempting but fatal. Pricing, UI/UX choices, and even customer-service scripts that work in Accra may feel alien in Amsterdam. The absence of localisation undermines credibility.

Leadership overstretch

When a founding team manages multiple markets simultaneously, decision latency grows. Research by Harvard Business Review shows that start-ups operating in more than two new markets at once experience an average 30 per cent drop in internal communication efficiency.

Compliance amnesia

Ignoring local labour, data, or tax regulations invites fines and reputational harm. In 2022, a pan-African logistics firm expanding into the EU incurred penalties for GDPR violations, an error born of assuming “common sense” compliance would suffice.

Each of these errors shares a root cause: founders mistake momentum for readiness.

What Successful African Start-ups Got Right

Not every story ends in retreat. Some African start-ups have navigated globalisation with striking discipline.

- M-Pesa, the Kenyan mobile-money pioneer, provides a prime example. Rather than blanketing the globe, it expanded only into territories with compatible telecom infrastructure and regulatory cooperation, notably Tanzania and parts of Eastern Europe. This selective approach preserved brand integrity and profitability.

- Paystack, acquired by Stripe in 2020, pursued partnership over independence. Instead of building its own foreign subsidiaries, it integrated into Stripe’s network, gaining compliance coverage and access to global payment rails.

- Andela, initially a coding-bootcamp model, morphed into a remote-engineering network connecting African developers with global employers. By shifting from physical expansion to digital globalisation, Andela sidestepped many logistical traps.

Data from UNCTAD Digital Trade Insights suggests that African digital-service exports grew by 15 per cent in 2023, proof that virtual expansion, when executed with localisation and legal awareness, can outperform physical relocation.

The Playbook for Sustainable Global Growth

If failure has patterns, so does success. Firms that expand sustainably follow a rhythm: diagnose, adapt, embed. Their playbook looks remarkably consistent across sectors and continents.

1. Expansion readiness before expansion rhetoric

A start-up must assess not only product-market fit but infrastructure-market fit, payroll systems, compliance frameworks, and governance processes that can withstand distance. The World Bank’s Enterprise Surveys show that businesses with formal internal audit systems are 40 per cent more likely to survive internationalisation.

2. Phase, don’t flood

Instead of launching simultaneously in multiple territories, successful companies test in one new region, collect data, and iterate. Sequoia Capital’s scaling model refers to this as “controlled asymmetry,” maintaining experimentation abroad while the core business funds stability at home.

3. Invest in cultural literacy

Global growth is a people problem before it is a capital problem. Cross-cultural training, inclusive hiring, and local leadership reduce friction. In the words of Harvard Business Review, “You can’t globalise values by memo.”

4. Partnership over presence

Form alliances rather than building from scratch. Partnering with local distributors, legal advisors, and payroll providers or EOR experts allows quicker regulatory navigation. This is especially relevant to foreign firms expanding into Africa, where local networks often determine the speed of market access.

A resilient scaling framework is not glamorous; it’s bureaucratic excellence combined with curiosity.

Lessons Beyond Africa: A Global Perspective

Africa’s entrepreneurial story offers lessons far beyond its borders. Start-ups across Europe, Asia, and the Americas increasingly face volatility similar to what African founders have long navigated: unstable currencies, unpredictable regulation, and fragmented infrastructure.

Three insights stand out:

- Resilience as a strategic asset

Operating in resource-constrained environments teaches efficiency. Founders accustomed to scarcity innovate faster when global conditions tighten. - Frugality fuels creativity

The “Jugaad” mentality of innovation through improvisation aligns with sustainability goals. Western firms facing margin pressure can learn from African models that treat limitations as leverage. - Failure as iteration

African founders often regard failure as field data, not defeat. That cultural trait is becoming globally relevant as even large corporations adopt agile experimentation.

The cross-pollination is reciprocal. As African firms globalise, and international companies localise within Africa, both sides refine their understanding of what “global” truly means: continuous adaptation.

Kharis Global Group: Building the Operational Backbone for Global Expansion

Even the most inspired global strategy collapses without operational scaffolding. Compliance, payroll, immigration, and local employment laws are often the hidden reefs that sink international ventures. This is where Kharis Global Group comes into focus.

A brief brand narrative

Founded in Ghana more than fourteen years ago, Kharis Global Group has grown from a small team into a multinational business-solutions firm with offices across Africa, Europe, and the Middle East. Its mission is simple yet ambitious: to make cross-border business possible without the usual administrative pain. The company’s culture blends Ghanaian pragmatism with global professionalism, a reflection of Africa’s evolving role in the world economy.

How Kharis Global Group fits into the expansion equation

While strategy determines where a company wants to go, Kharis Global Group ensures it can stay there legally and operationally. Our integrated services address precisely the pain points that cause expansion failure:

1. Employer of Record (EOR) – Allows companies to hire and manage staff in new countries without setting up a legal entity. This drastically reduces time-to-market and risk exposure.

2. Global Payroll and Tax Compliance – Manages salaries, benefits, and taxation across jurisdictions, ensuring full adherence to local regulations and social-security obligations.

3. Immigration and Work-Permit Support – Handles business visas, work authorisations, and expatriate relocation logistics. These often derail expansion efforts when mismanaged.

4. Regulatory and Legal Advisory – Keeps clients aligned with labour codes, corporate governance standards, and industry-specific compliance requirements.

5. Strategic Business Consulting – Offers tailored advice on entering high-growth markets, especially across Africa and the Middle East, where regulatory systems can be opaque.

A client testimonial from the company’s site notes that its immigration-services partnership began in 2014 and “continues to this day with consistent professionalism.” That continuity speaks to the invisible success metric of expansion: stability.

Kharis’ model demonstrates a practical truth often missing from glossy start-up playbooks: global expansion fails not for lack of vision but for poor paperwork.

Conclusion

Global expansion is a seductive phrase. It conjures maps, new offices, and investors nodding over espresso in distant capitals. But beneath the glamour lies the grind of legality, logistics, and localisation.

The African experience shows that ambition alone is insufficient; resilience, adaptability, and operational maturity decide who survives abroad. Whether it’s a Lagos fintech entering Europe or a Dutch logistics firm entering Ghana, success hinges on the same equation: strategic patience plus local partnership.

For founders and executives reading this, the lesson is plain: expand intentionally, not impulsively.

Contact Kharis Global Group for global expansion solutions in Africa, the UK, the Netherlands, the UAE, and Canada.