What is co-employment?

Co-employment is a legal and structural arrangement where two or more separate entities simultaneously share the legal responsibilities and liabilities of an employer for a specific worker or group of workers. In this model, the worker is legally considered an employee of both companies at the same time.

Commonly associated with Professional Employer Organizations (PEOs) and staffing agencies, co-employment creates a partnership where administrative and operational tasks are split between a “Primary Employer” (the PEO or agency) and the “Worksite Employer” (the client company).

The Mechanics of a Co-employment Relationship

In a standard co-employment agreement, the division of labour usually follows a specific pattern designed to optimize business efficiency while maintaining legal standards:

- The PEO (Primary Employer): Focuses on the “back-office” HR functions. This includes processing payroll, withholding taxes, providing employee benefits (like health insurance), and maintaining workers’ compensation insurance.

- The Client (Worksite Employer): Maintains day-to-day control over the employee. This includes hiring decisions, setting work schedules, providing the tools for the job, and managing the employee’s performance and output.

While this allows small and medium-sized enterprises (SMEs) to offer “big-company” benefits, it also means both parties are potentially liable for labor law violations, such as workplace discrimination or wage-and-hour disputes.

The Legal Risks of Co-employment

Understanding the legal landscape of co-employment is vital for risk management. Because the law views both entities as employers, an employee can legally sue both parties for a single grievance.

1. Shared Liability for Labor Violations

If a manager at the client company engages in discriminatory behavior or fails to pay overtime, the PEO—as the co-employer—can be held financially responsible, even if they had no direct involvement in the incident. Conversely, the client can be held liable for the PEO’s failure to remit payroll taxes.

2. Regulatory Compliance

Different jurisdictions have varying tests to determine if co-employment exists. In the United States, for example, the Department of Labor (DOL) and the National Labour Relations Board (NLRB) use “Economic Realities” or “Right to Control” tests to see if a company is exerting enough influence over a worker to be deemed an employer.

3. Benefit Plan Risks

If the boundaries of co-employment are blurred, it can lead to issues with the Employee Retirement Income Security Act (ERISA). Companies must be careful that their benefit plans are structured to include or exclude co-employed workers, specifically to avoid “unintended plan participants.”

Co-employment vs. Employer of Record (EOR)

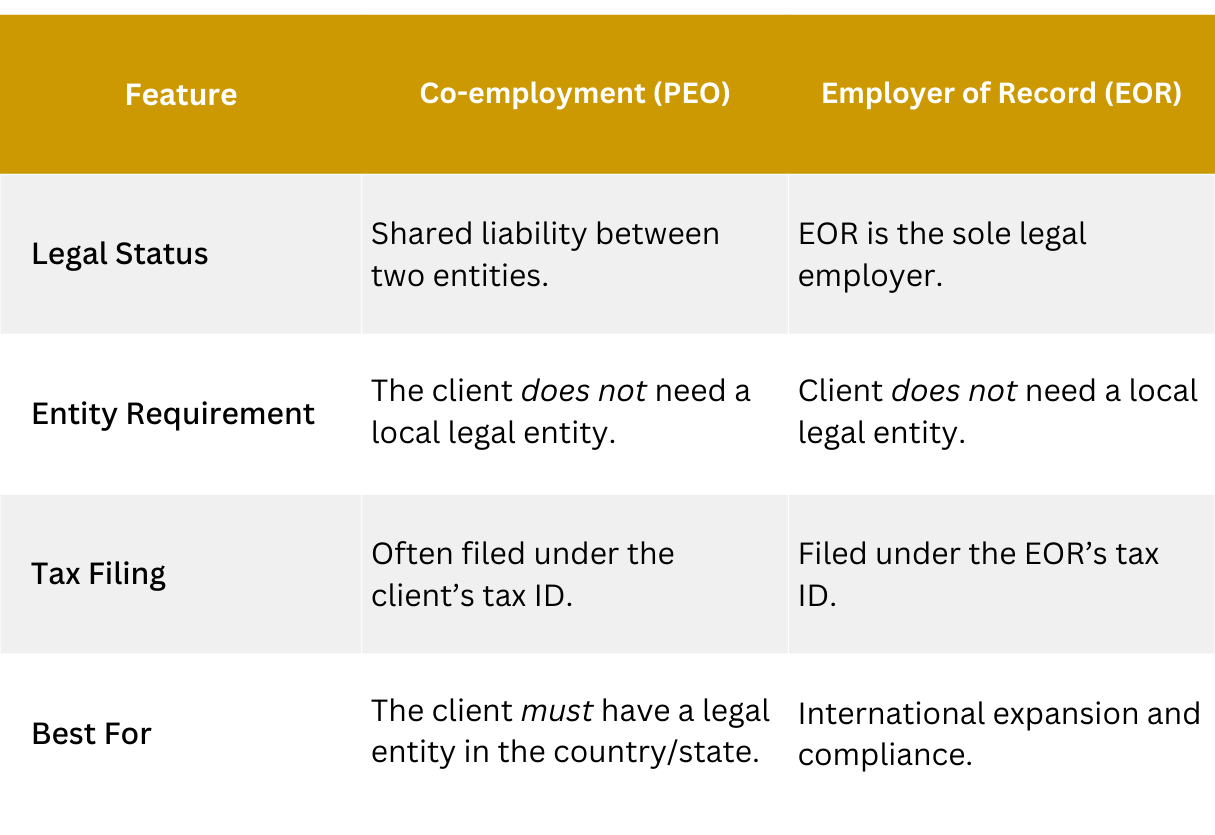

It is common to confuse co-employment with an Agent of Record or an Employer of Record (EOR) service. However, the legal distinction is significant, especially for global expansion.

Our EOR model is often preferred for international clients because it removes the co-employment risk from the client entirely by taking on the full legal burden in the host country.

Managing Co-employment Risks Effectively

To benefit from this model while minimizing exposure, businesses should follow these best practices:

- Clear Contracts: Ensure your Service Level Agreement (SLA) clearly defines which party is responsible for specific HR tasks and who bears the cost of legal defense in a dispute.

- Due Diligence: Partner with reputable organizations. Check for certifications, which provides certain tax certainties and protections for clients.

- Training: Even if you share an employer relationship, ensure your internal managers are trained in local labor laws and anti-discrimination policies to prevent the “worksite” incidents that lead to shared liability.

- Insurance Review: Confirm that your Employment Practices Liability Insurance (EPLI) specifically covers claims arising from co-employment arrangements.

Conclusion

Co-employment is a powerful tool for business growth, offering a path to better benefits and streamlined HR administration. However, it requires a sophisticated understanding of shared liability.

For businesses looking to hire across borders without the complexities of shared legal risk, exploring an Employer of Record solution may be the safer alternative to a traditional PEO model.

Frequently Asked Questions About Co-employment

Does co-employment mean I lose control over my employees?

No. In a co-employment model, the client retains full “direction and control” over the workforce. You decide who to hire, who to fire, what their daily tasks are, and how your company culture is shaped. The PEO simply handles the administrative paperwork.

Why do companies enter into co-employment agreements?

The primary driver is economies of scale. By joining a PEO, a small company with 10 employees can “pool” its workforce with thousands of other workers under the PEO’s umbrella. This allows them to negotiate lower rates for health insurance, workers’ compensation, and retirement plans that would otherwise be unaffordable.

Is co-employment the same as a joint employer?

While the terms are similar, “joint employer” is often used in a legal or regulatory context (especially in litigation) to describe two companies that share control over a worker, even if they didn’t sign a formal co-employment agreement. Co-employment is usually a proactive, contractual business arrangement.

How does co-employment affect workers’ compensation?

Under co-employment, the PEO usually provides the workers’ compensation coverage. A major benefit here is the “exclusive remedy” rule. Because both the PEO and the client are considered employers, in many jurisdictions, an injured worker who receives workers’ compensation is barred from suing either the PEO or the client company for the injury.